Global private investments for local private investors

Welcome to Spire Capital

Deep specialisation - over 15 years of expertise in global private markets

Spire Capital is an independently owned private investment firm specialising in global private markets. The firm has been searching, sourcing, researching and investing in global private market investments since 2009 and has built a strong track-record spanning investments in private equity, venture capital, private debt, private infrastructure and private real estate. Led by research, Spire leverages a global network of proprietary relationships to identify premium private market funds, co-investments and direct secondary investments to execute investment views.

Client centric – over $2.2bn invested on behalf of Australian private wealth

Spire Capital is proud to serve a large clientele of family offices, private wealth firms and high net worth individuals with over $2.2bn1 invested since inception. Depending on requirements, local investors can access a range of solutions including Spire’s flagship Spire Global Private Markets Portfolio and a curated list of Wholesale2 investments spanning high conviction funds and direct co-investments. Customised mandates are available for investors with AU$100m+.

Australian investors benefit from Spire’s extensive funds management experience to ensure global private market investments are customised to local tax, legal, administration, currency and reporting requirements. Spire’s national Investor Relations team provides local support for researching, onboarding and monitoring Spire investment opportunities.

Results and relationships – investment success and an enjoyable journey

Investing in private markets requires patience as value is created over the long term. Spire Capital is focused on investment results while recognising that transparency and relationships matter along the journey. Spire’s semi-annual Reporting Season provides interaction with key investment professionals as part of sharing progress of investments along the way. Monthly and quarterly reporting provide additional insights while Spire’s local Investor Relations team serves client relationships with professionalism and care.

Why Private Markets?

Improved risk-adjusted returns

Private markets have historically delivered compelling performance outcomes for investors. Top-quartile private market funds consistently outperform public market equivalents across economic cycles, providing a valuable contributor to a diversified portfolio.

Annualised volatility and return, 1998-2025

Annualised volatility and return 1Q98-1Q25

Source: Bloomberg, Burgiss, FactSet, NCREIF, PivotalPath, Standard & Poor’s, J.P. Morgan Asset Management.

How is outperformance generated?

Active Ownership

Business plans drive growth: Leading private equity firms drive value at the company and asset level. This includes execution of detailed business plans focused on accelerating earnings growth.

Expert Support: Business plans are executed with the support of high-quality management teams and industry advisers, typically appointed by the private equity firm.

Alignment and Entrepreneurial Governance

Incentives: Private equity-backed boards and management teams are typically heavily incentivised by Management Incentive Plans and/or personal investment in the company. The share register is typically small and visible.

Nimble Boards: Boards are typically smaller, contain industry experts, meet more frequently and are less constrained by ‘governance correctness’, which if often a criticism of public markets.

Avoid short term market reporting: The reporting and administration challenges of being a listed company can also cost and can be a distraction for boards who are seeking growth.

Information Advantage (relative to public markets)

Detailed due diligence: A company sales process is typically 3-9 months long enabling prospective investors to meet with management teams and perform customer calls while formally conducting commercial, legal, tax and ESG due diligence. In essence, private market investors are able to become ‘legal insiders’ as extensive due diligence is undertaken.

Art of the deal: The value of a private market asset may be driven by non-price considerations. Some assets are not for sale but win-win outcomes can be negotiated when there is limited competition.

Quick wins: A detailed business/ value creation plan targeted at realising the true potential of the company creates a ‘running start’ as improvements can be strategically implemented from the day of execution.

Complexity (relative to public markets)

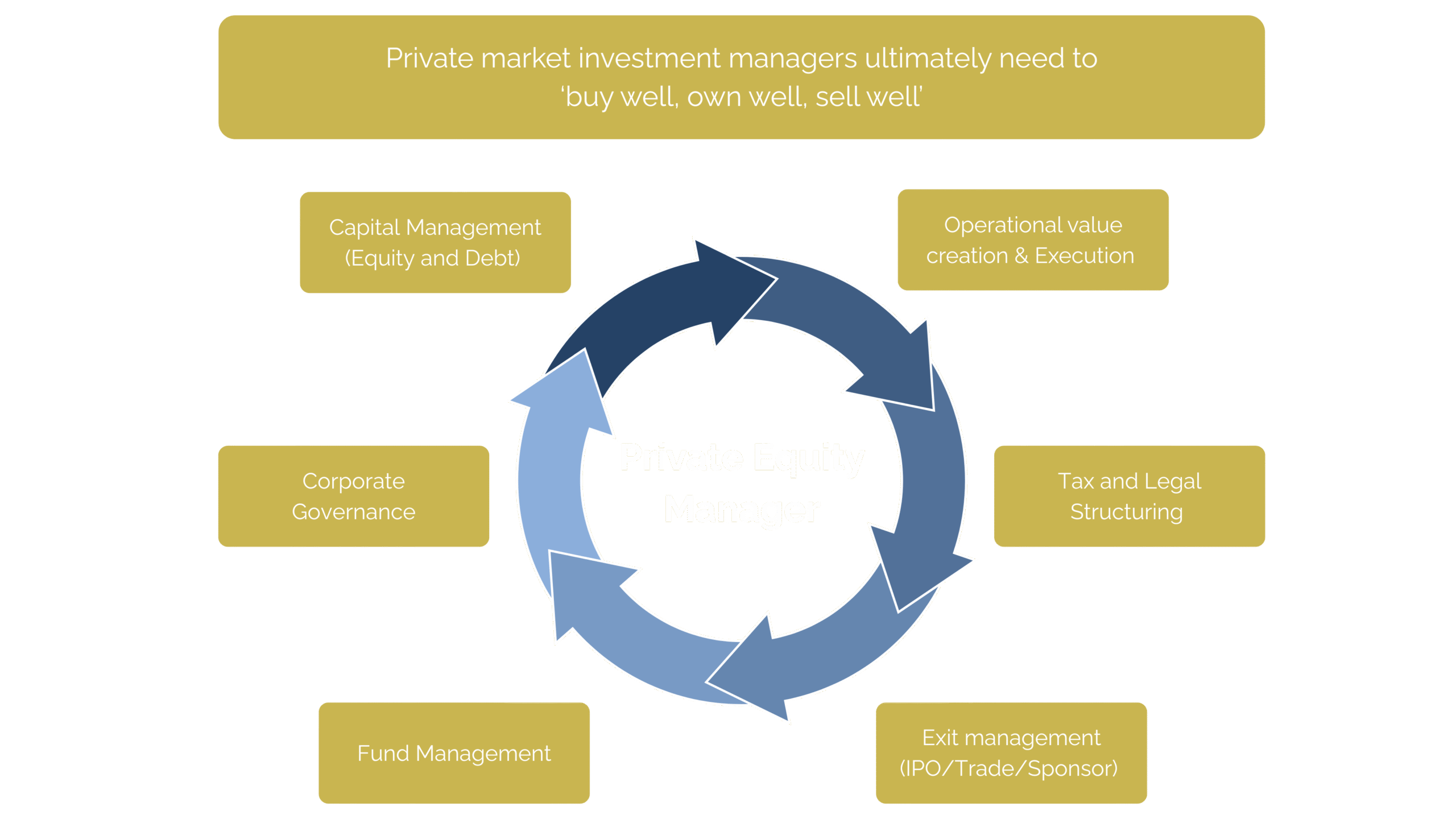

Private equity managers drive performance through leveraging the complexity premium and information advantage of private markets. Private equity managers ultimately need to ‘buy well, own well, sell well’.

Value creation is achieved through:

- Capital Management – Optimising the capital structure through strategic use of equity and debt

- Operational Value Creation & Execution – Driving revenue growth, margin expansion, and operational improvements within portfolio companies

- Tax and Legal Structuring – Implementing efficient structures to minimise tax leakage and maximize net returns

- Exit Management – Timing and executing exits through IPOs, trade sales, or secondary buyouts to realize value at optimal valuations

- Funds Management – Actively managing portfolio construction, allocation decisions, and investor capital throughout the fund lifecycle

- Corporate Governance – Installing effective boards, management teams, and governance frameworks to align interests and drive accountability

Complexity (relative to public markets)

Why Spire Capital?

Spire Capital has been serving investors since 2009. Over this period, the firm has innovated and refined focus to become one of Australia’s leading private markets firms serving family offices and high-end advice firms. Combing a global network, deep research and cross-border funds management, Spire makes investing in high quality private market investments easy and rewarding.

Curated menu of high growth investment options

Spire Investment Solutions offers Wholesale* investors a rolling menu of highly differentiated deal-flow across private equity, private credit, private real estate and private infrastructure. The Spire Investment Team proactively searches, sources and researches investments in line with 2 broad categories:

Strategic – capitalising on mega-themes and carefully targeted ‘sweet-spots’ for investment (e.g., digital infrastructure, protein consumption)

Tactical – opportunistic investments to take advantage of a temporary market dislocation, mispricing or arbitrage opportunity (e.g., distressed debt and venture capital secondaries)

Investors are typically offered direct access to stand-alone Wholesale* investments alongside Spire’s flagship Spire Global Private Markets Portfolio in capacity constrained opportunities.

*Australian “Wholesale” as defined by Section 761G(4) of the Corporations Act

Diversified private market portfolios with liquidity features

For investors seeking an efficient and diversified approach to global private markets, Spire offers multi-asset, multi-manager portfolio solutions with an ongoing liquidity feature. The investment approach is underpinned by a Global Relative Value approach to steer deployment across and within the private markets.

Implementation is via a combination of funds, co-investments and direct secondaries within an evergreen fund structure allowing investors to add or redeem interests over time. The flagship Spire Global Private Portfolio has been customised for Australian investors seeking a target net return of 10-13% p.a. over rolling 7-year periods with low volatility and low correlation to listed markets.

Working with clients to design and implement a customised mandate

For larger investors (i.e., $100m+), Spire works with investors to refine mandate settings across investment, fund and governance considerations. This includes fund set up, investment management, portfolio management, currency management, the establishment of policies, oversight committees, reporting and relationship management.

Curated menu of high growth investment options

Spire Investment Solutions offers Wholesale* investors a rolling menu of highly differentiated deal-flow across private equity, private credit, private real estate and private infrastructure. The Spire Investment Team proactively searches, sources and researches investments in line with 2 broad categories:

- Strategic – capitalising on mega-themes and carefully targeted ‘sweet-spots’ for investment (e.g., digital infrastructure, protein consumption)

- Tactical – opportunistic investments to take advantage of a temporary market dislocation, mispricing or arbitrage opportunity (e.g., distressed debt and venture capital secondaries)

Investors are typically offered direct access to stand-alone Wholesale* investments alongside Spire’s flagship Spire Global Private Markets Portfolio in capacity constrained opportunities.

*Australian “Wholesale” means ‘Wholesale Clients’ as defined by Section 761G and 761GA of the Corporations Act 2001 (Cth)

Diversified private market portfolios with liquidity features

For investors seeking an efficient and diversified approach to global private markets, Spire offers multi-asset, multi-manager portfolio solutions with an ongoing liquidity feature. The investment approach is underpinned by a Global Relative Value approach to steer deployment across and within the private markets.

Implementation is via a combination of funds, co-investments and direct secondaries within an evergreen fund structure allowing investors to add or redeem interests over time. The flagship Spire Global Private Portfolio has been customised for Australian investors seeking a target net return of 10-13% p.a. over rolling 7-year periods with low volatility and low correlation to listed markets.

Working with clients to design and implement a customised mandate

For larger investors (i.e., $100m+), Spire works with investors to refine mandate settings across investment, fund and governance considerations. This includes fund set up, investment management, portfolio management, currency management, the establishment of policies, oversight committees, reporting and relationship management.